ESG needs a rethink: AI technology holds the key

Concerns around ESG investing, and ESG more generally, are rapidly growing among industry leaders and regulators globally, due to questions about its true returns potential and the prevalence of greenwashing. Just ask Elon Musk, who thinks ESG is a ‘scam’, or the former Chairman of the Japanese Government Pension Investment Fund’s (GPIF) Eiji Hirano, who believes there are signs of a bubble in ESG investing. Recent headline grabbing greenwashing news about giants like DWS, combined with the raging debate about the credibility of ESG ratings, have only compounded the challenge. So, are times about to change for the current darling of investors – ESG?

A raft of regulatory interventions has come to the fore in recent months – from the Sustainable Finance Disclosure Regulation (SFDR) in Europe to the Securities and Exchange Commission’s own Task Force on Climate-Related Financial Disclosures (TCFD) aligned regulations in the US. However, the elephant in the room is this: How do we truly harness the potential of ESG? To understand the issue, we need to delve deeper into how ESG is integrated today by businesses and investors, and where AI can ultimately help.

There are currently several key issues dogging the ESG ratings and investing world:

- Regulation: ESG regulation is evolving. And fast. The challenge of competing regulations, jurisdictions, interoperability, alignment and more makes the adoption tardy at best when it comes to assimilating policies and regulation across the global markets. While businesses are still struggling to meaningfully integrate ESG, there is already pressure on them to report on TCFD and soon on TNFD, the Taskforce on Nature-Related Financial Disclosures.

- Data assurance: Data assurance in ESG integration needs to be addressed urgently and comprehensively. The breadth, availability and veracity of underlying ESG data is key to overcoming the issue of greenwashing, and the subsequent risk to the investors. We should be monitoring and properly validating ESG data, working with its subjectivity rather than overlooking its subjective nature but, in order to deliver meaningful results, in relation to ESG.

- Expertise and capability: There is currently a significant talent gap in the ESG market, which is only going to worsen as various stakeholders, from businesses and consulting firms to ESG ratings companies and financial institutions, fight for the limited talent. The talent gap ultimately affects the application of ESG, and the quality of the underlying data being collated and provided to or by businesses. Talent supply will only grow as academic institutions start to scale up their offerings in this space.

- ESG integration: Without the required talent depth and tools, ESG integration continues to be predominantly superficial across a great number of businesses. This is not helpful in any way, as it only adds to the doubts surrounding ESG’s usefulness. Businesses, more than anyone else, need to recognise the usefulness of ESG adoption if it is to become truly material in the manner it ought to be.

Simply put, the rigour of ESG analysis is far from what is generally observed in areas such as financial analysis or business planning. As the CEO at an AI enabled analytics platform which has conducted its own research and discussions over a cross section of global firms, I believe that while ESG continues to be used by many investment professionals as a tool for marketing, this does not always translate into real integration nor gain traction with the decision-making units in the c-suite and boardrooms. ESG clearly needs a rethink.

Key to enabling this change will be the selective integration of AI technology into current ESG processes and methodologies. Major ESG players have been experimenting with the use of AI to enhance their ESG ratings outputs. But the nebulous nature of ESG aspects continues to make this very difficult, if not impossible, through traditional machine learning (ML) approaches. The issues outlined above only add to the challenge.

A good starting point would be a calibrated approach involving a careful mix of human intervention and capability, backed by AI-based tools which will provide the most practical and meaningful results. This will enable the ‘quality assured scalability’ that is needed to fundamentally improve ESG integration, minimise greenwashing and deliver on the promise of ESG.

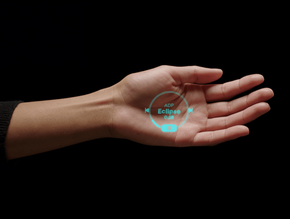

The focus will also need to be on leveraging AI across areas such as rapid data aggregation, data quality assurance, analytics and smart reporting to achieve effectiveness and efficiency. Additionally, AI application with the environmental sensors-based data aggregation could provide a critical data aggregation mechanism, which could then be integrated with the business end of the spectrum.

Leveraging AI through a combination of these steps will help drive deep and meaningful business integration and related analytics based on the bottom-up designed models to deliver real results. And with this, the times may in fact change for the better for ESG.